Table of Content

Exempt employees, otherwise known as salaried employees, generally do not receive overtime pay, even if they work over 40 hours. For more information about overtime, non-exempt or exempt employment, or to do calculations involving working hours, please visit the Time Card Calculator. Also known as payroll tax, FICA refers to Social Security tax and Medicare tax.

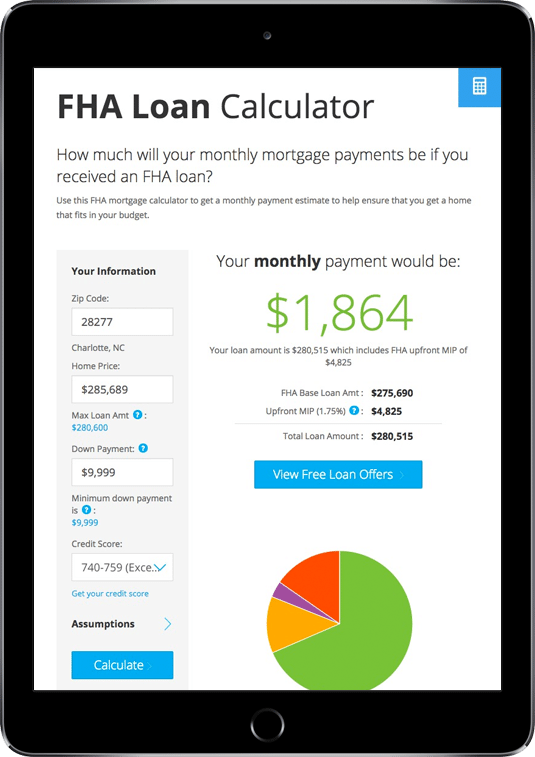

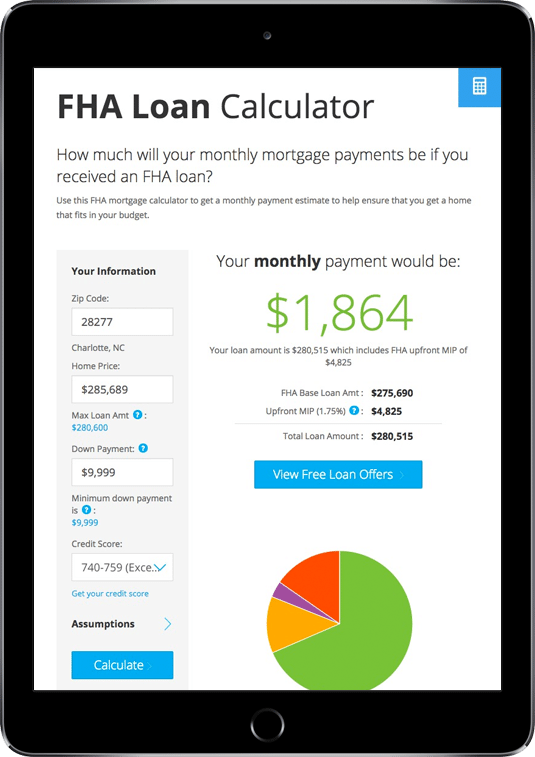

Normal basic pay is equal to either 50% of your CTC or 40% of your gross pay. To keep things simple, use Vakilsearch salary calculator online. Veterans and active military may qualify for a VA loan, if certain criteria is met. VA loan benefits are what make house affordability possible for those who might otherwise not be able to afford a mortgage. Zillow's affordability calculator allows you to customize your payment details, while also providing helpful suggestions in each field to get you started.

Understanding the calculations of monthlytake-home salary

Debt-to-income calculatorYour debt-to-income ratio helps determine if you would qualify for a mortgage. The default is for 5 days a week, but if you work a different number of days per week, change the value here and the "Daily" results column will reflect the change. On 23rd September 2022 Chancellor Kwasi Kwarteng announced that the 1.25% increase in National Insurance contributions which took effect in April would be reversed.

The information on this website is for the purpose of knowledge only and should not be relied upon as legal advice or opinion. The CTC varies between firms depending on the advantages offered by a company, and your take-home pay is based on your CTC. Buying with bad creditIf you have bad credit and fear you'll be denied for a mortgage, don't worry. Refinance calculatorInterested in refinancing your existing mortgage?

Salary Calculation Formula

New Brunswick has the lowest minimum wage in Canada at $11.75 per hour. Outstanding Loan Balance is calculated using the formula given below. Fixed Monthly Payment is calculated using the formula given below. Please note that we are a facilitating platform enabling access to reliable professionals. We are not a law firm and do not provide legal services ourselves.

You pay tax on the value of these benefits, but not National Insurance. If your tax code is used to collect the extra tax, you do not need to enter your benefits here. To know the break-up of your gross salary, you can contact your employer or look through the monthly payslip. The calculator uses the CTC input by the user along with the tax regime selected. Through back-end workings, it estimates the annual tax applicable as per income tax slab rates applicable. Sometimes, it is possible to find avenues to lower the costs of certain expenses such as life, medical, dental, or long-term disability insurance.

Does variable pay form part of the components of CTC of an employee?

You can edit this number in the affordability calculator advanced options. Also known as homeowner's insurance is a type of property insurance that covers a private residence. The cost may vary depending on your location, type of coverage, any discounts you qualify for and your insurance provider. Generally, homeowner's insurance costs roughly $35 per month for every $100,000 of the home's value. You can edit the calculator's default amount in the advanced options. If you do receive such benefits, enter the value of the benefits into the box and choose whether this is on a yearly, monthly or weekly basis.

It's important to review these values as they'll impact the take home calculations when breaking down by hour, day and week. The most common term for a mortgage is 30 years, or 360 months, but different terms are available depending on the type of home loan that works best for your situation. You can edit your loan term in the affordability calculator's advanced options. Alternatively, your employer might provide you with a cash allowance which increases your take-home pay. Both income tax and National Insurance are due on such allowances.

Here are the current federal tax brackets and marginal rates:

Use our refinance calculator to see if refinancing makes sense for you. You've estimated your affordability, now get pre-qualified by a lender to find out just how much you can borrow. Instead of the usual columns in the results table, you will see your yearly totals and a comparison of your bonus period with a normal period.

If you receive cash allowances, like a car allowance or mobile phone allowance, and this is also included in your pensionable pay, tick the "Include cash allowances" box. If you are being awarded a bonus by your employer, enter the £ value of this bonus and choose your normal pay period. If you know your tax code, enter it here to get a more accurate calculation of the tax you will pay.

It is typically calculated to be 50% of the basic pay for people who live in big cities. It is expected that for workers who live in non-metropolitan areas, the amount will be 40% of their basic pay. This amount is partially or completely free from taxation as per Section 10 of the Income Tax Act.

This makes it easier for an employee to know the amount he/she would have at his/her disposal every month. Some people get monthly paychecks , while some are paid twice a month on set dates and others are paid bi-weekly . The more paychecks you get each year, the smaller each paycheck is, assuming the same salary.

On the high end of the minimum wage, British Columbia pays $15.65 an hour, $626 a week, $2,713 a month, and $32,552 a year. In Ontario and Alberta, that's $15 an hour, $600 a week, $2,600 a month, and $31,200 a year. In Quebec, that's $14.25 an hour, $570 a week, $2,470 a month, and $29,640 a year. A Voluntary Provident Fund is a type of PF in which an individual can pay a percentage of his\her pay to an Employee Provident Fund account. You must remember one point that this is a voluntary plan, and there is no compulsion that each company has to contribute an equal amount to the EPF. A portion of the employee's salary is placed in their PF account.

After all deductions such as provident funds and taxes have been made, the employee pays the total amount. In most cases, the net compensation is less than the gross income. However, it may be equal when the income tax is zero, or the amount payable to the employee is less than the government tax slabs.

No comments:

Post a Comment